quickly.

by Ryan Hamic PT DPT

When I started researching for this blog I never thought that would be the conclusion I reached. Yet there it is. Now to be clear I am not saying you shouldn’t pay them back at all (that is just deeply unethical)… but I am saying given the right circumstances you might consider paying them back as slowly as possible. I know, I know, that flies in the face of every good piece of financial advice that has probably ever been given to you. Pay back your debts quickly, so you can get moving forward has moved from sage advice to financial dogma in our culture, which completely ignores this advice and just keeps piling up debt anyway. Public debt has grown from about 7 trillion to 12 trillion dollars in the past 12 years, with Student loan debt rising considerably to now make up 10% or more of current total debt.

Strategic interlude:

My last blog entitled On Indentured Servitude and the Cost of Physical Therapy Education, explored the situation the current DPT student is facing and how it is not just possible, but likely that most DPTs entering the workforce face 6 figure debt. If your reaction while reading this post is that these new DPT’s were frivolous or foolish in their acquisition of this debt I encourage you to go read that first. You are welcome to continue disagreeing after that or to debate with me or anybody else the reasons, but at least acknowledge the argument. I am happy to engage on this topic as we need to offer some meaningful change in this area or our profession is going to struggle attracting talented young professionals vital to fulfilling the promise that PT holds as a profession to our society.

In the interest of full disclosure I fully paid off my student loans. I was able to do this because prior to accruing them I had been working in a completely different field and with the help of my wife and loved ones was able to make strategic investments that allowed me to use those profits to pay for my education. I took out $90k in loans at an interest rate that was less than I was earning from these investments and then paid the loans off prior to capitalization. If you are in this situation that is fabulous and you should pay off your debt as quickly as possible and get back on the road to producing personal wealth while practicing debt free. I do not, and I posit that you should not, forget that the vast majority of your classmates, present or former are not in this situation and could not possibly have been.

Back to the Thesis:

So we know that student debt is exploding in this country and median wages have stayed stagnant for 40 years. We have also established it is very likely for graduating DPT students to be graduating with 6 figure debt. Further we know that median PT starting wages are about $66,545. Throughout the course of a PT career we have a relatively low slope curve that moves to a median PT salary of $82,930 as of 2014. Now those may not be Wall Street like top 1% numbers, but they are pretty darn good, especially for a profession with the amount of benefits that PT gets. Let’s face it our jobs are great, we get to help people heal in more ways than one. It is the last bastion of healthcare that truly gets to spend dedicated time with our patients on a regular basis and quite frankly you probably didn’t choose this profession for the cash flow potential. For those who dispute the relative value of our incomes I would like to point out that our starting median salary is in the 90th percentile and our average median income is in the 94th percentile. Not too shabby.

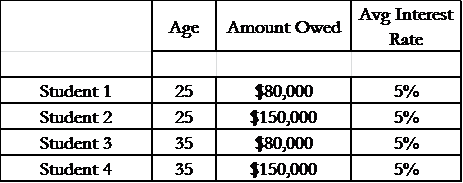

How on earth can I advocate top 10% wage earners paying back their loans slowly? Well it really comes down to the math, an understanding of cash flow, and the necessity of investing early for retirement. Let’s imagine 4 graduating students with a relatively simple combination of situations:

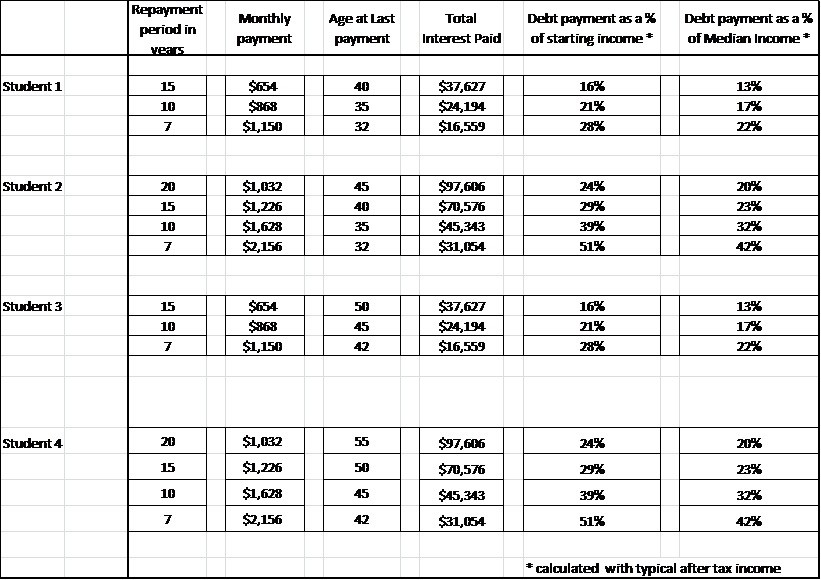

Now let's look at the Debt Repayment characteristics for these students:

The second table shows the debt repayment scenario for these students. Let’s take a moment to digest those numbers. Pretty grim. So many things I could say about this, but let’s highlight a few.

1. A freshly minted DPT with $150k in student loans will be expected to give up a minimum of 24% of their after tax salary just to pay student loan debt. I am a married father and there is not a single item in my budget that touches that percentage of my after tax earnings.

2. If you went back to School in your 30’s and took loans to do so, you are very likely to be paying your loans back until at least your upper 40’s.

3. Somebody getting very Spartan in an attempt to pay back $150k in 10 years or less is going to have to absorb at least 40% of their after tax income being used to pay debt.

These percentages might be tenable if PT’s after tax income’s was well into 6 figures, but I am not sure how this makes any sense when our take home pay is between $50k and $62k per year. Perhaps we need a new calculation for the topline of our budgets, “income after taxes and student loan payment”. In reality a fresh DPT with $150k in debt is likely bringing home between $24k and $37k per year. Put in these terms we are presenting physical therapists with practicing the first 15-20 years of their professional career with a take home budget less than the median for all workers regardless of educational background. This presents physical therapists with a true cash flow problem and presents our profession with a very dirty little secret that we better fix or hope it never sees the light of day. I wonder how many DPT programs would share these blogs with a prospective student?

Any normal reading of this situation would take into account the total interest to be paid on these loans and most would see the total interest paid column and think I do not want to pay nearly $100k in interest alone! I better hurry up and get these paid off: Back up the truck of Ramen Noodles, showering is for the uber elite, let’s start farming bees to make candles we are shutting off the lights! Not so fast there.

Get to the POINT!

Admittedly there has been a lot of table setting to this point and not a lot of food on the plate of my central idea here. So let’s get right to it. If you are a student facing debt repayment of this magnitude why should you consider paying it off as slowly as possible? Well here it is: if you pay your loan off as slowly as possible and you put the difference towards investing for retirement during that period you will come out ahead in the end, substantially ahead! Remember my thesis here is that all other things being equal you are more likely to be better off choosing a slower payoff rate and investing the difference than you are to pursue a more aggressive payoff strategy and waiting to invest. Let’s look at some examples. Warning: Math Ahead!

For all examples the following assumptions apply. Investment is in a stock index fund yielding an average annual return of 7% (realistic based on tracking over the past 40 years). Retirement income is calculated from a 4.0% lifetime annuity on the amount saved at age 65.

Example 1:

25 year old new DPT with $150k in loan:

Option A: Let’s start with what most will assume is the right action, viz. first pay off your loan then invest for retirement. After all, you are only 25 years old and retirement is a long ways away. So let’s say you choose a 20 year payoffand have a monthly payment of $1032/month. You pay the debt off at age 45, then continue to invest this $1032/month into your retirement account. Total financial Sacrifice over 40 years = $495,360. At age 65 you will have $543,226 in retirement savings. Annual retirement income = $21,729

Option B: Now let’s assume you choose a 10 year payoff and get real aggressive on paying down your loan prior to investing. You pay out $1628 per month in order to abolish that loan by age 35. From 35 on you invest the same $1032/month in your retirement as the option above. Total financial sacrifice = $566,880 over 40 years Congratulations you retire with $1,251,688. Annual retirement income = $50,067.52

Takeaway from example 1:

Given the choice between aggressively paying down debt and then investing or going slow on your debt and then investing, the winner is clear. Suck it up now and you will have a substantially larger retirement income. We learn from this if your idea is to pay down your debt prior to investing then there is no substitute for speed.This idea however is patently wrong from a financial perspective when it comes to low interest rate debt. So I present to you example 2.

Example 2:

25 year old new DPT with 150k in loans:

Option A: Now let’s assume our new DPT is really thinking long term. This DPT believes “I am really willing to suffer now for a solid future” they decide to pay off the loan as fast as is realistically possible (10 years at $1628/month), then they continue to invest that aggressive amount ($1628/month) until 45 years old. Following that they invest $1032/month for the next 20 years until age 65. Total financial sacrifice = $638,400. Their retirement savings will be $1,660,840 yielding an annual retirement income of: $66,434

Option B: This time our DPT chooses a 20 year loan pay back with a monthly payment of $1032. They take the difference between this and the 10 year payoff amount and invest it starting right away at age 25. In this case every month for the first 20 years they contribute $1628 to debt servicing and retirement savings. They then continue from age 45 to 65 to contribute $1032/month to their retirement. Total financial sacrifice = $638,400 ( THE SAME AS OPTION A!), but their retirement savings will be $1,757,235 equal to an annual retirement income of: $70, 289

Takeaway from example 2:

Well here is the real deal. Both options required a precisely similar financial outlay on the part of the DPT, yet the slower loan payback actually yielded a greater retirement savings! This is further compounded by the amount of deductible interest paid over the life of the loan by the longer term payer, allowing them to end up with more money back in their annual budget. Think about that for a minute.

I have run this calculation for several age groups and for several debt levels and all reveal the same thing. You are better choosing the longest debt repayment time and investing the difference of what you would have paid over the shorter term. The reason for this is the difference in interest rates between your student loans and expected ROI. Due to this you must use your own individual situations and of course be advised that all investments entail risk.

What about Income Based Repayment Options?

So we have rather convincingly proven my point here. All things being equal pay your loan back as slow as possible while investing the difference along the way. Let’s not ignore the elephant in the room though. Those percentiles are frankly insane. Dedicating 30-40% of your after tax income to servicing a loan and saving for retirement is simply not realistic if you also intend to purchase a home, open a clinic, raise a child, or periodically enjoy food that cannot be rightly described as “nutrient rich paste”. This is not to say that paying back your loans traditionally is impossible. In fact if you and your spouse both have solid incomes, you budget well and live within your means I would argue it is actually reasonable and you will certainly be able to setup a quality retirement. If you are not married and have to do this single you will likely have to accept the reality of a roommate or some other hybrid living situation in order to accomplish this.

Fortunately there are other options for debt repayment that may allow you to maintain reasonable cash flow, save for retirement and purchase a home all while paying your student loans. For federal loans these are called “IDRP’s” or income-driven repayment plans. If you are a borrower I urge you to investigate these. A good place to start is this link. The gist of these types of plans is that your payment is taken as a percentage of your discretionary income. Depending on the plan this sets your maximum payment at 10-15% of your discretionary income.

Example:

Age 35 married with 2 children loan amount $150k:

Median salary of 82,390 = discretionary income of $45,940. 10%-15% of this amount equals a monthly payment of $382 – $574.

That is an absolutely massive difference in your monthly budget. What’s more this now affords you a realistic opportunity to start stuffing your retirement savings early with the difference!

With these plans they also include a stipulation for loan forgiveness typically at 25 years of payments for those attending graduate school. Since you all attended graduate school you will need to pay this amount for 25 years in order to finally be absolved, but at that time the government will write the remainder off and you will not have a default recorded against you.

*Edit 7/28/16 I neglected to explicitly mention that upon loan forgiveness, the paid off portion of your debt will be subject to income tax, so you will need to prepare for that. *End Edit*

So let’s take this new amount and apply it to our previous example. So instead of our extremely smart and incredibly Spartan DPT in Example 2 (Option B) above who chose to pay off his loans in 20 years and use $1628/ month or 32% of his take home pay for 20 years to service his debt and invest, they choose an IDRP plan. They now have a monthly loan payment of $382. Being smart they start investing right away, saving $650/month (which just happens to be the difference between the 20 year loan repayment rate and the IDRP rate). They pay this $1032 per month for 25 years at which time the remainder of their loan is forgiven. They continue to invest this same amount for 15 years until age 65. They retire with the most money of any of our examples $1,789,410 for an annual retirement income of $71,576. What’s more they only paid $495,360 into debt servicing and retirement savings, compared to the $638,400 they paid in the previous example. So they end up with the fattest stack for the least money.

In a mind blowing example of the value of investing early and taking advantage of IDRP’s, the DPT who did this paid the exact same amount over 40 years as our first example 1 option A, but he ended up with $1,300,000 more in retirement savings!

There are simply way too many factors for me to list all of the potential scenarios here, but at bare minimum this underscores the need for you to truly research your options in paying back your student loans. It also should serve to underscore the importance of early investment for retirement. Now get out there and start paying back those student loans….slowly.

Be on the lookout for my next Blog:

“You are Broke, you just don’t know it yet!”

We will discuss concrete steps to take with your finances to prepare you for affording and enjoying your life as a DPT and human being. I promise some concrete things you should absolutely be doing to make sure your money is working for you and not the other way around.

Ryan Hamic PT, DPT

Disclaimer: I am not a financial adviser and do not pretend to be one. All should be responsible for their own due diligence.

Follow PMT on Twitter: @Phxmanual

Like us on Facebook: https://www.facebook.com/phoenixmanualtherapy/

Check out our Website for Upcoming Classes taught by clinician’s for clinicians: www.phoenixmanualtherapy.com